This is part 2 of a series on Building a Financial Plan. This posts covers reducing expenses and increasing income as part of a financial plan.

Reducing Expenses

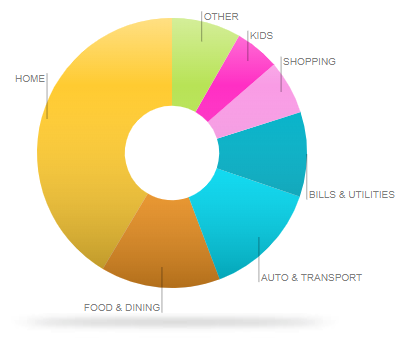

Considering the time and effort I spend at work to earn an income, it makes sense to dedicate energy towards finding ways to reduce expenses. I track my expenses on mint.com since it automatically categorizes expenses and provides detailed charts and drill down capabilities. The “Trends” section provides good ideas on where to focus. I’ve focused my efforts on two different strategies:

- Eliminating or reducing recurring expenses and subscription services.

- Reducing latte factor expenses.

Here’s a few areas where I’ve found success in reducing my monthly expenses:

- Mortgage refinance for lower interest rate

- Taking a lunch to work rather than buying lunch eat day.

- Eating out less as a family.

- Negotiating a lower DirecTV bill

- Negotiating a lower mobile phone bill

- Negotiating a lower internet service bill

- Installing a weather aware sprinkler controller to reduce water utility spend

- Installing a nest thermostat to reduce heating utility spend

- Installing smart switches to automatically turn off lights in the house.

- Replacing paid cable service with an over-the-air antenna DVR system.

- Turning off the gas fireplace pilot light.

Income Growth

Reducing expenses and extensive budgeting can only get you so far. A financial plan should also include plans on ways to increase the size of the pie. I track my income growth rate to understand whether I’m keeping ahead of inflation. However, in the workplace I focus my energy on creating the maximum value and impact to the business. I’ve found the salary increase naturally follows my business impact.

Another way to increase income is to put your hard-earned dollars to work for you. In earlier years, the returns were relatively small and not substantial. Over time, the power of compounding makes made this a much bigger portion of my take home.

Finally, side hustles are a great way to create opportunities for income growth. There are times when I catch myself draining my cognitive surplus into Netflix and other fleeting, time sinking activities. Why not redirect that energy to something productive? I am frequently inspired by stories of individuals who started a side hustle that turned into something that eventually allowed them to replace their income and quit their job.

Stay tuned for part 3 of Building a Financial Plan.