Do you know your credit score? If not, then Credit Karma is a must-have weapon to have in your personal finance arsenal. Founded in 2007, Credit Karma provides free credit scores and credit reports from national credit bureaus TransUnion and Equifax, as well as daily credit monitoring from TransUnion.

What is a Credit Score?

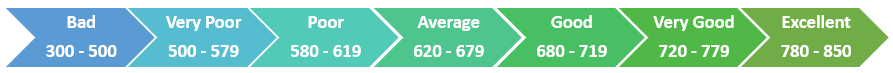

A credit score is a measure of credit worthiness and is a key factor that lenders use to determine whether to loan money. Credit score values range between 300 and 850. The higher the value, the more attractive a prospective borrow is to a lender. The score is based on a variety of factors including payment history, credit card use, credit age, derogatory marks, total accounts, and hard inquiries.

Why Credit Karma is Awesome

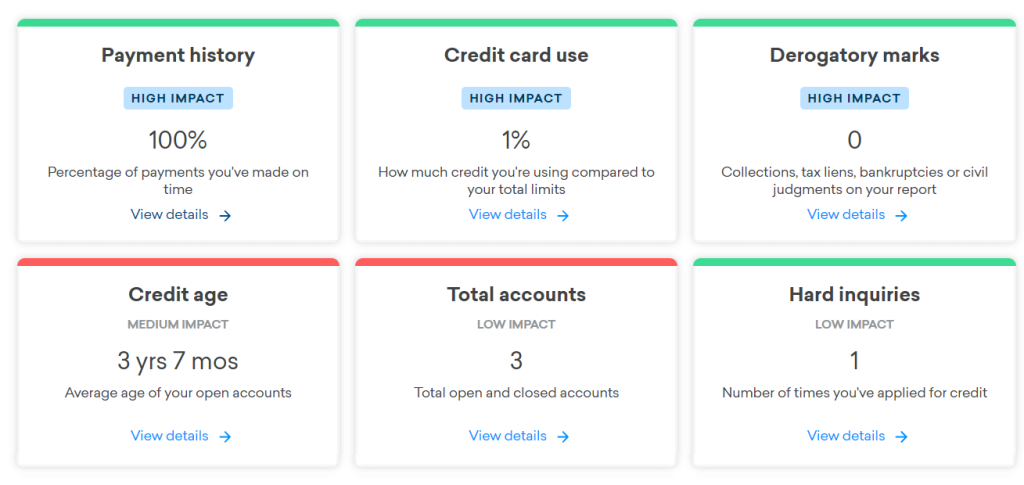

Credit Karma excels at helping you understand the factors behind your score so you can improve it. The “credit factors” view helps you visualize which areas on your credit report are most impactful to your final score. By drilling into each area, you can find tips on how to improve your rating:

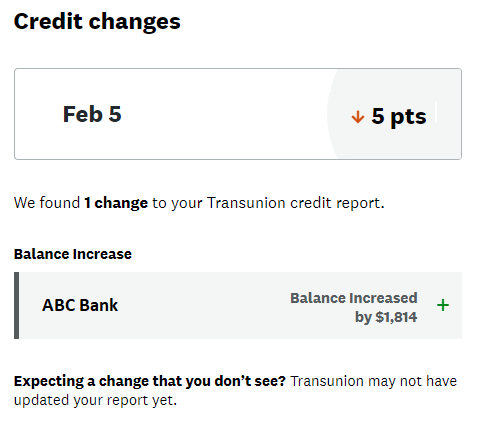

The monitoring service is another useful feature which will notify you when your TransUnion score changes and also provide insights into what caused the change:

How much should you care about your score?

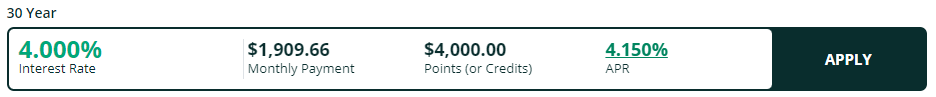

A high score can be a key factor in helping you to obtain the best possible interest rate deals with lenders. If you plan to borrow money in the future, then it’s important to ensure you keep yourself in the 780+ range. Provident Funding’s Quick Rates Calculator is a helpful tool which you can use to see the impact of your credit score on the loan terms. Here’s a comparison of the interest rates offered to one with an excellent credit score versus an average credit score using an $500,000 purchase example with 20% down:

For the above example, a borrower with average credit would pay $20,591.58 more in interest over the life of the loan. An additional $3,000 in loan points are also needed to obtain the loan. $23,591.58 in total savings is well worth the time and effort.

Hat tip goes to my brother-in-law “J” who has successfully achieved a perfect credit score of 850. While the milestone is commendable, “anything over 800 is just a bonus and likely won’t result in better lending rates of other perks” [1]