College tuition prices are insane. If you haven’t started saving for your children’s college experience then get ready for sticker shock. My situation is even worse because there will be a point in time when three of my four children are simultaneously attending college.

Setting a Savings Target

The best place to start is with one of these college savings plan calculators:

To get an accurate number from the above calculators, I had to make a few assumptions:

- Education inflation rate – 4.8%

- Rate of return – 4.5%

- Annual tuition – estimate of annual tuition and books in today’s dollars. Assuming my children want to go to my alma mater, they will need $6,468. I rounded this up to $10,000 in case they opt for a something more expensive.

- Annual room and board – estimate of annual room and board in today’s dollars. My alma mater is $7,628 today. I rounded this up to $10,000 to also cover transportation and other personal expenses.

After plugging in the numbers for my four children, the total number comes to $541,679:

Variables

There are several factors that will significantly impact my required savings target:

- Scholarships and grants – how much scholarship money will my children receive?

- Opting out of college – what if one or more of my children doesn’t want to pursue higher education?

- More expensive school – what if my kids want to go to a prestigious Ivy League School?

- Graduate education – what if my kids want to become a doctor, a lawyer, or pursue some other graduate degree?

Funding Sources

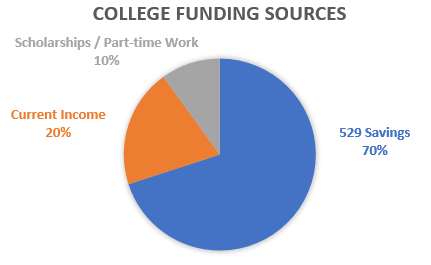

I want my children to be invested in their college education by working hard to qualify for scholarships. I’m perfectly fine if my kids exchange part-time work hours for study time that helps them with scholastic achievements that lead to scholarships or admission to the school of their choice. I also recognize that full-time scholarships are not guaranteed, so I’ve settled on the following funding source breakdown:

Here’s my reasoning for this breakdown:

- 70% from 529 Savings – these are tax advantaged accounts that allow tax free growth for qualified education expenses. Ideally all of my expenses are paid with these funds to maximize the tax break. However, I don’t want to save too much since excess funds will trigger the original tax plus a 10% penalty from the IRS.

- 10% from Scholarships – I expect my kids to contribute 10% which is ideally funded from scholarships. If they don’t qualify for scholarships then a part-time job will help them put skin in the game and demonstrate commitment to their education.

- 20% from Current Income – this is the last resort and also provides a buffer to protect against having too much 529 savings. I expect this to be feasible since my mortgage will be paid off by then. Any scholarships beyond 10% also means I get to hold onto more current income and redirect it elsewhere.

Backup Plan

I want to have a backup plan in case my children don’t qualify for scholarships, I’m unemployed, or my 529 Savings account loses value from a stock market crash. Here are my backup funding options in priority order:

- Taxable savings accounts – funds from investment accounts and company stock purchase plan.

- Federal loans – Sallie Mae loans with low interest rates and deferred payment options.

- Roth IRA – early withdrawals are penalty free if they are used for qualified education expenses. This is a last resort since this impacts long term retirement savings. Replacing this money is hard since there are limits to incoming contributions to this account.

Choosing a 529 Savings Plan

529 plans are sponsored by individual states. You don’t have to live in the state to participate in its plan. I recommend choosing a plan that offers Vanguard funds with very low fees. About eight years ago I setup accounts for my children at my529 which is sponsored by the State of Utah. My home state of Washington doesn’t offer a 529 Savings plan and instead offers a prepaid tuition program. Prepaid tuition plans work by purchasing credits that can be redeemed towards college expenses. 400 credits translates to a four year degree program cost in the State of Washington. After the market crash in 2008, the state prepaid tuition program was significantly underwater. In subsequent years they have significantly increased the prices to make up for the difference. I’m not willing to pay a premium now to cover for losses back in 2008. Instead, I’ve chosen to use a 529 Savings plan that allows me to direct the investments in low cost Vanguard funds.

Monthly Savings

When accounting for my children’s ages, my current 529 Savings balance, and my savings target, I arrive at a monthly savings contribution amount of $990 which I round up to $1,000. While this is a sizable amount to stash away each month, it’s worth every penny if my kids are able to have a college education opportunity similar to the one I was blessed to have many years ago.

What about you? What would you do differently?

I would suggest that children be taught at an early age these costs of a college education and the value of education. A parent should also keep in mind that each child is different. Some may not have the personality or inclination for a traditional college degree in the arts or sciences but may be more interested and passionate about technology fields, industrial arts, or mechanics. In any case, they should be taught that an education is very important but expensive. Training on how to successfully prepare for and qualify for scholarships can greatly improve their potential to obtain scholarships that can contribute to much more than ten percent to the cost of their education. Your time invested in helping your children understand HOW to obtain scholarships can bring a much great return on the investment than cash investments.

Great point about investing time towards teaching kids to work hard and about the costs and value of an education. Those investments will definitely have a much higher rate of return!