So your home offer was accepted and now you have 30 days to close on your purchase. You are now in a race to complete your home inspection and line up your financing. You were probably already pre-approved for a loan (otherwise your offer would not likely be accepted). However, now it’s time to go shopping and finalize the details of your loan: what type, term, and interest rate can you afford?

Let’s get a few things out of the way: don’t consider an interest only mortgage or an adjustable rate mortgage (ARM). If those are your only options then the home is more than you can afford. That leaves the choice between a 30 year mortgage and a 15 year mortgage. With a 30 year mortgage you spread out the payments over 30 years which reduces your monthly payments drastically. This helps with month to month cash flow but also results in paying a lot more interest in the long run. For example, consider a $625K home with 20% down and a 500K mortgage:

| Loan Term | Interest Rate | Monthly Payment | Total Interest Paid |

| 15 years | 3.375% | $3,543.80 | $137,883.87 |

| 30 years | 4.25% | $2,459.70 | $385,491.80 |

| Difference | $1,084.10 | $247,607.93 |

If you can afford the higher monthly payment, then the 15 year term seems like the obvious best choice because you save $247K in interest payments. But is it really the best choice? It depends.

What can you afford?

The traditional guidance is that you shouldn’t spend more than 35% of your pretax income on mortgage, property tax, and home insurance payments. A more conservative model is to limit your housing expenses to 25% of your after-tax income. How much you choose to spend depends on your monthly expenses and existing debt. For most people, a 30 year mortgage is the only option within reach. Even if you can scrap together enough to make the 15 year mortgage payment each month, you still need enough money and cash flow for food, clothing, kids, cars, travel, etc. Stretching yourself too thin makes you “house poor” and limits your financial freedom and flexibility.

Investing the Difference

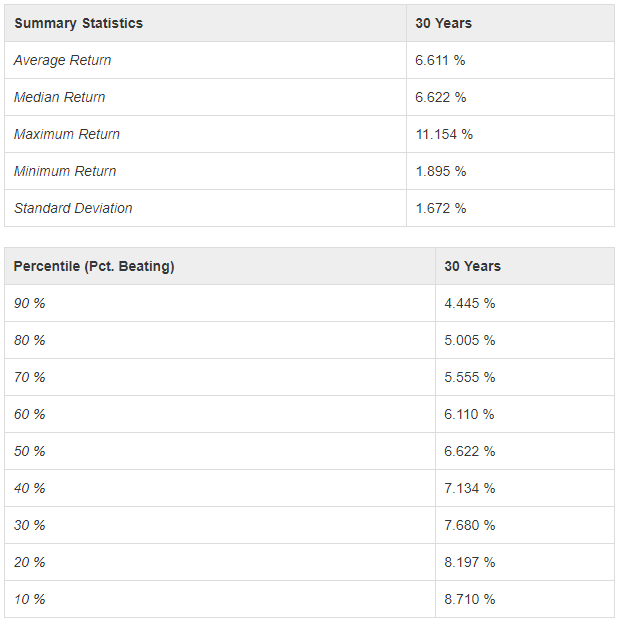

Let’s suppose you don’t have a cash flow problem and want to choose the option that will yield the best financial outcome. If you invest the $1,084 payment difference in the stock market, the outcome can change drastically. Using the S&P 500 as a proxy for the stock market, the average annual return over all 30 year periods is 6.611% (adjusting for inflation). If you diligently invest your payment difference each month (and reinvest dividends) and assume an average annual return of 6.611%, the outcome after 30 years is significantly different:

| Loan Term | Monthly Payment | Total Interest Paid | Total Invested | After Tax Capital Gains |

| 15 years | $3,543.80 | $137,883.87 | $637,883.10 | $380,933.12 |

| 30 years | $2,459.70 | $385,491.80 | $390,274.89 | $709,855.69 |

| Difference | $1,084.10 | $247,607.93 | $247,608.21 | $328,922.57 |

| Gains minus total interest plus interest deduction |

$81,314.63 |

As seen in the table, even though you spend more on interest with the 30 year mortgage, the stock market investments will more than make up for the difference. You are actually better off choosing the 30 year mortgage and investing the difference. However, market returns are not guaranteed and ~25% of all historical 30 year return periods had net negative results for the 30 year mortgage when accounting for inflation and taxes. I arrived at this number by first calculating the break even S&P 500 return rate of 5.1754%. Then I found where that fits into the return distribution chart:

Source: https://dqydj.com/sp-500-historical-return-calculator/

Deciding Factors

Choose the 30 year mortgage for the following reasons:

- You cannot afford the higher monthly payments of the 15 year mortgage.

- You are 100% committed to investing the difference in monthly payment.

- You are willing to take a ~75% chance that you will gain money from investing the difference. Of course, past results do not guarantee future performance!

- You are financing a rental property and want to remain cash flow positive (letting your tenants pay your mortgage for you).

Choose the 15 year mortgage for the following reasons:

- You can afford the higher monthly payments.

- You value the financial freedom and peace of mind of not having mortgage payments after 15 years in the future.

- You do not want to risk a ~25% chance that you will lose money from investing the difference. Of course, past results do not guarantee future performance!

Other Considerations

Most people do not live in their homes for 30 years. According to a study published by the National Association of Home Builders, the average ranges from 11-14 years. This means a 15 year mortgage buyer who “trades up” will end up with mortgage payments beyond the original 15 year period. This tilts the calculations above further in favor of the 30 year mortgage option. Of course, if you plan to live in your house forever or purchase future property with cash, this doesn’t apply to you.

Reference Spreadsheet

Feel free to tinker with the spreadsheet I used to calculate these numbers. You can download the Excel file here: Mortgage Comparison.