What is Lending Club?

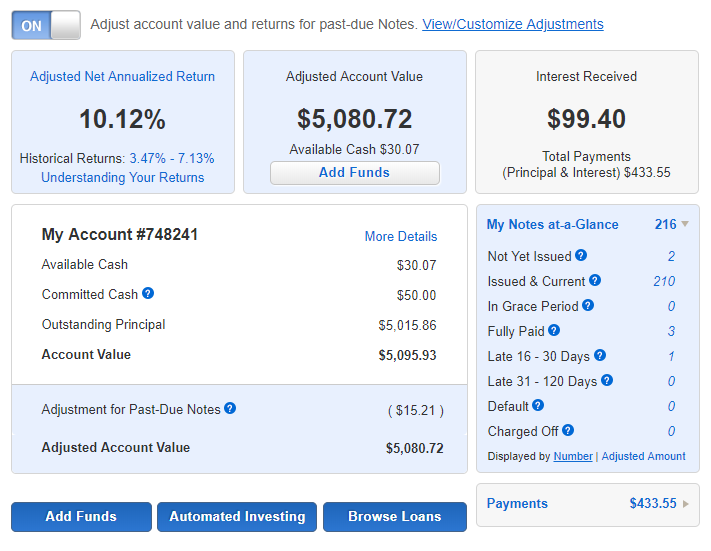

I’m always on the lookout for ways to diversify my portfolio. Lending Club is a very attractive fixed income alternative for those with an appetite for more risk. At its core, Lending Club a peer to peer lending company that connects borrowers with investors for personal, medical, auto, and business loans. The service allows you to diversify fixed income investment money across loans of various degrees of risk. For example, with a $5,000 investment you can invest $25 in 200 separate notes.

When you open a savings or checking account at your local bank with a tiny interest rate of 1%, the bank will turn around and issue loans with your money at much higher rates and then pocket the difference. Lending Club allows you to “cut out the middle-man” and keep the interest for yourself.

Fees

Lending Club collects a 1% service charge on loan payments. Additional charges are not incurred for prepayments (and the associated uncollected interest). For loans that go to collection, you may also incur a separate collection charge of up to 35% of the payments that are recovered. You can read the fine print here.

Set it and forget it

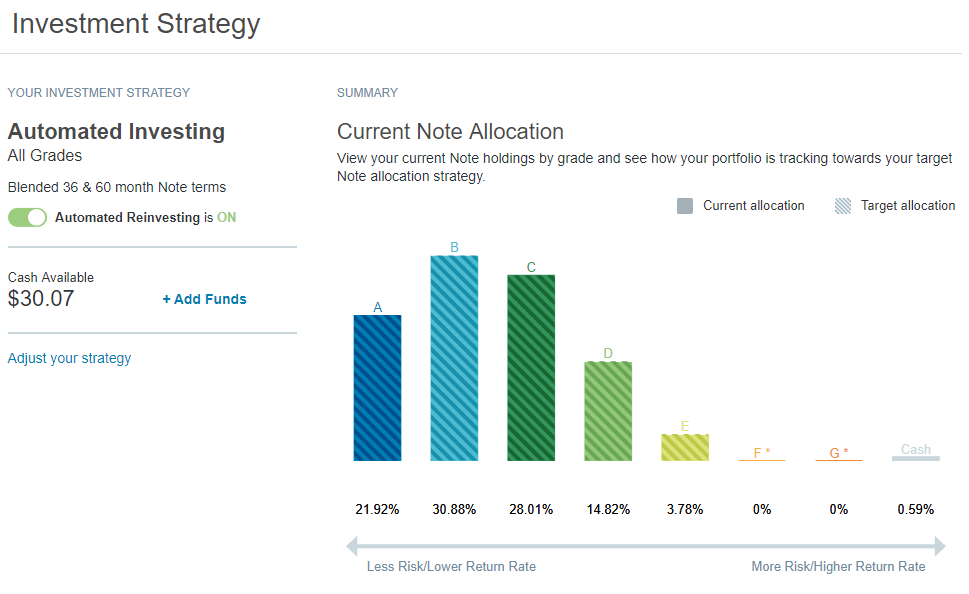

My favorite part about Lending Club is that it provides an option for automated portfolio diversification across risk profiles. When you configure automated investing, you select a mix of loan grades, risk exposure, and projected return based on historical data. You can also configure automated reinvesting which allows you to take advantage of the power of compound interest.

Risks

There’s no such thing as risk free investment and Lending Club investments have exposure to the typical risks associated with fixed income investments:

- Default Risk – borrowers may fail to make payments. This exposes you to loss of principal and interest, disruption of cash flow, and increased collection costs. These loans are not secured with property and thus these loans fetch higher interest rates due to the increased credit risk.

- Prepayment Risk – if interest rates go down, borrowers may be inclined to prepay the principal and refinance at a lower rate. If interest rates go up, your money may be committed to notes paying lower interest as long as 3 to 5 years.

Tax Considerations

The interest on these fixed income investments are taxed at the ordinary income rate. This will be higher than the capital gains rate you will pay on stock sale proceeds held longer than one year. You can minimize your tax burden by opening a tax advantaged retirement account with Lending Club. Traditional, ROTH, SEP, and SIMPLE retirement accounts are all supported.

Who should invest and why?

Lending Club is a good option for fixed income investors with an appetite for higher risk and rewards. This is not recommended as the core of your portfolio which should be spread across stock and bond index fund asset classes. Rather, this can be used to diversify and supplement your investment strategy to increase your net return.

For emergency savings funds, I’ve been using a ladder of CDs from Ally Bank which has reasonable early withdrawal fees before the five year term is up. Lending Club offer the ability to liquidate your notes on the secondary market and presents an interesting alternative for emergency savings. Thoughts?

Promotions

You can get a $25 bonus if you sign-up with this link and invest $5,000. There’s also a promotion to link your account to your United MileagePlus account to earn miles redeemable for rewards. Upon the transfer and investment of the first $2,500 of New Funds, a new investor will qualify to receive 1,250 miles. For every dollar of new funds transferred and invested in excess of $2,500, a new investor will qualify to receive .5 miles, up to a maximum aggregate bonus of 100,000 miles per calendar year.

Additional Reading

- http://www.lendingmemo.com/p2p-lending-recession-performance/

- https://investorjunkie.com/29452/lending-club-prosper-risky-investment/

- https://www.fastcompany.com/3029896/when-starting-a-loan-business-during-the-recession-wasnt-a-terrible-idea

- https://www.bloomberg.com/news/features/2016-08-18/how-lending-club-s-biggest-fanboy-uncovered-shady-loans

Screenshots

Ping me if you have questions!